By one measure, the hottest trend in housing has gone to the dogs.

As in pet dogs.

Some 60 million American households, about half, own a dog, and most of those dog owners prefer to open their back door to let their pets out. For that, they need a house.

Enter single-family residential (SFR), and its newer cousin, build-to-rent (BTR) communities. One of the prime players in this space, NexMetro Communities, offers 1-bedroom, 1-bath villas that rent for $1,600-$2,000 a month in its Avilla communities in Arizona, Colorado, Texas and Florida.

Who rents a one-bedroom villa?

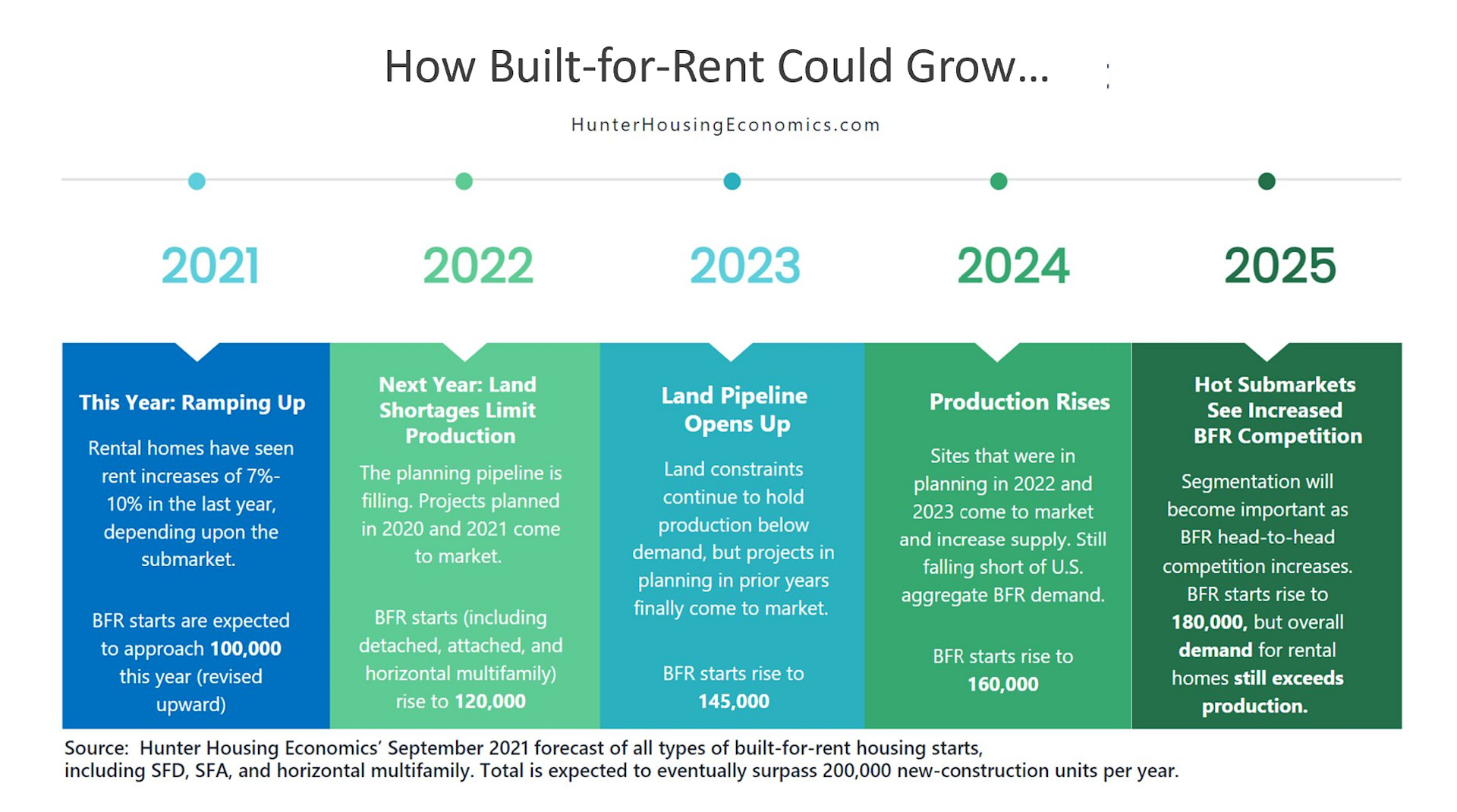

“Singles with dogs,” says Brad Hunter, the principal of Hunter Housing Economics, who wrote about the booming build-to-rent sector in Forbes last year, which he estimates will reach some 700,000 total units by the end of 2025 and is attracting some $30 billion in capital from a variety of institutional investors.

NexMetro makes a direct appeal to pet owners on the web site of its Avilla rental communities, where an adorable Jack Russell with a blue chew toy in its mouth fills the screen, along with this text: “We are a pet-friendly community welcoming your furry friends with open arms with no breed restrictions. We also offer a dog park that is perfect for your pets to play and socialize.”

In these Avilla communities, two-bedroom, two-bath homes start at about $2,200 and 3-bedroom, 2-bath homes start at about $2,800 for 13-month leases. Rents are substantially higher, $3,200 and $4,600 respectively, for 6-month lease terms.

It’s not just about the dogs. The moment for build-to-rent has arrived, and the smart money has flocked to the space.

Chronicling the rise of build-to-rent

NexMetro, which now has some 7,900 build-to-rent (also referred to as build-for-rent, or BFR) homes completed, under construction or in development, opened its first Avilla projects in Tucson in 2011.

It has completed about 52 Avilla Homes projects, according to Jacque Petroulakis, vice president of marketing and investor relations, and an additional 2,300 homes in 13 neighborhoods are in the planning stages.

While Avilla is friendly to the dog lover, and a tenant can let a pet out the back door, this is not a case of Lassie frolicking in a field. The “back yards” range from about 200 square feet in the 1-bedroom “Alcove” villas to upwards of 700 square feet in the “Haven,” the 3-bedroom, 2-bath rentals.

The upscale finishes in the homes, which include 10-foot ceilings and quartz countertops, appeal to a certain type of renter.

“We’re data junkies and we really take time to survey our residents,” said Petroulakis. “There is an appeal to this hybrid option.”

Residents can move into a detached home, without the closing costs, insurance and maintenance hassles of owning a house.

They are millennials who want flexibility; renters who are in a "life transition," either newly married or newly divorced, who do not want to make a mortgage commitment; and baby boomers who are tired of clogged gutters and broken HVAC systems, but want the privacy of a single family house.

These communities often have shared amenities, like pools, tennis courts, fitness centers and dog runs.

Petroulakis has witnessed the shift in attitudes about SFR investing.

“Five years ago when I was talking about SFR, I had to explain what it was,” she said. “Today, it’s white hot.”

NexMetro recently cashed in on the “white hot” build-to-rent sector, where they have staked a claim to the upscale market. It announced on Nov. 1 that it closed on a $37.2 million sale of its 89-home Avilla Paseo project in north Phoenix, which translated into nearly $418,000 per unit, more than double the per-unit sale price in 2018 of Avilla homes in Goodyear, Ariz.

A partial solution to the housing shortage

America is some 3.8 million homes or so short of what’s needed, according to Freddie Mac, and it’s clear the build-for-rent communities will satisfy some of this outstanding demand.

Hunter identified seven institutional investors who committed about $10 billion in capital to the single family residential/build to rent space in 2020, including major players like J.P. Morgan, Blackstone, Pretium Partners and Ares Management, Koch Industries and Brookfield.

That number has only grown since, and now includes a commitment last June of $5 billion in capital to Mynd from Invesco Real Estate Group for home purchases, along with a $40 million funding round; and a joint venture announced in July by the Toronto-based investment firm Tricon Residential, which plans to invest $5 billion in single-family rental homes in the U.S. in partnership with Teacher Retirement System of Texas and Pacific Life Insurance Company. Invitation Homes and American Homes 4 Rent are also major players.

While these institutions are competing with buyers in the most desirable markets — think Atlanta, Phoenix, Austin, Houston, etc. — 2-3 percent of single family residential homes are owned by investors, compared to about 55 percent of the multifamily market.

Doug Brien, the CEO of Mynd, which has created an end-to-end technology platform for real estate investing and property management, describes BTR as “the gateway drug” for large investors for single family residential.

“Once institutional investors get into purpose-built housing,” he said, “they will push into scattered sites for single family residential.”

Rental housing no longer carries the stigma it once did, Brien said, and many millennials are more comfortable leasing big items.

With mortgage rates now drifting past 6 percent, affordability issues are cropping up in some markets. Renting is a necessity for many in the current market.

Though the returns on the SFR asset class are lower these days, in some cases down to 3 percent, their stability and predictability offer advantages over the market for office and retail space, which is plagued with uncertainty.

This has led to keen competition for homes in the country’s growing areas, chiefly the Sun Belt and the Southwest.

Economies of scale drive BTR developments

Developers of BTR communities can save substantial sums by using the same materials they can purchase in bulk, and utilizing a limited number of floor plans. Some industry insiders refer to BTR as “horizontal multifamily.” It also allows for greater density, anywhere from 4-8 units per acre, as opposed to 2-3 units for SFR developments.

And for some, the result is a different animal from typical single-family residential.

“They’re actually designing a product that I don’t find necessarily attractive, but it’s attractive to the renter,” Mike Moser, the CEO of Starwood Land Advisors, told the New Home Insights podcast by John Burns Real Estate Consulting at the end of October.

At the same time, he sees the attraction to the space for investors and those companies who can handle the difficult job of managing thousands of homes, who are counting on significant rent increases in the years to come.

“A lot of the rents that I see now are simply eye-popping,” Moser added.

The ability to increase density, and the competition to find places to build, is also driving up land values.

“There has been a gold rush,” said Don Ganguly, senior vice president of Mynd Investment Management. BTR developments take from 9 months to 18 months to come online after the projects have been approved, so if a developer overpays for land and cannot compensate by charging higher rents, the numbers could start to get shaky.

NexMetro sees this as the biggest obstacle to growth.

“The challenge in the future will be skyrocketing land costs,” said Petroulakis.

The remote office fuels remote development

Many believe workers will no longer commute, or will commute only a few days a week. This would make housing in the exurbs more attractive, and more resilient to downturns, than it has been historically. And many people working from home are looking for bigger houses that have space for home offices.

Still, there are limits.

“There’s a certain percentage of jobs that will become permanently remote,” said Ganguly. But even then, “not too many people want to go to the boonies to live.”

Some other housing experts agree, and see BTR developments in outlying areas as vulnerable.

“They’re building them too far out,” John Burns told Mynd in an interview at the Midtown Hilton in New York a couple days after his annual real estate conference, held at the Plaza Hotel on Nov. 2. “I’m not that optimistic that there is that much demand in outlying areas in Phoenix.”

But those more remote areas are often more hospitable to development, since, as Burns said, “cities are really pushing back on this because they don’t understand this product.”

The housing market is often driven by forces its stakeholders cannot control, primarily regulatory issues, which can lead to a “mismatch” between supply and where the demand is, according to David Zanaty, chief real estate officer at Mynd.

“Housing gets built when it can get built, and where it can get built,” Zanaty said. “It’s often the path of least resistance that determines where it goes up.”

An attractive asset class in a tight market

Burns advises clients of his real estate consulting business that there is still room to grow in the BTR space. While Brad Hunter predicts about 700,000 BTR homes will come online by the end of 2025, Burns and others put the number lower, at about a half million.

“We’re telling them there’s a long tail here to build new rental communities across the entire country,” Burns said. “Where we are urging caution is in the outlying areas.”

Some experts lament the thin margins, with cap rates (essentially return on investment) falling to around 3 percent, and foresee a risk that rents will not rise as predicted. But others say there are few options for solid investments, what with equities on a historic run and bond markets lagging.

“What’s a good investment these days?” asked Burns. “Investors see this as an inflation hedge."

There are not a lot of place to look for strong returns these days.

"It’s a good risk-adjusted reward, even at these low rates,” Burns added.

And many predict an upside.

“Bulls think there is room to raise rents,” he added. “The labor market is tight and people are getting raises, so they can pay more rent.”

Jeff Hutchinson, the head of portfolio acquisitions at Mynd, said SFR, despite the complications of management, has proven its viability since the Great Recession of 2008-09.

“It’s been established that SFR is an attractive asset class for more sophisticated capital,” he said.

The next evolution, BFR, “offers better operating efficiencies and the ability to control your own destiny,” Hutchinson added. “You can work with a developer that selects a good site, and work with a builder that has a good reputation.”

Residing in a ready-made community, which has the look and feel of an SFR and the accompanying amenities, is compelling for a group other than millennials not ready to buy or boomers tired of dealing with landscapers or handymen.

“There are people who lost homes in the Great Recession,” Hutchinson said, “who don’t want to own a home again.”

Build-to-rent bets remote work is the future

“We’re in the first inning of this thing,” Mynd’s David Zanaty says of the BTR boom. “We’re going to see how this evolves as we get into the second and third innings and we learn more about consumer preferences.”

The winners will need to get the homes and the geography right. Zanaty believes we are moving into a world where consumption patterns are changing, and some will choose to rent their primary residence and purchase a home in another place as an investment.

John Burns, for one, is not so sure the millennial generation prefers renting to buying.

“The home ownership rate has basically stayed the same,” he said. “No one has been able to prove statistically that people want to rent.”

The question for BTR developers is how much runway they have before the rental boom levels off, and how the developments far from the urban cores will fare in the next downturn.

“Demand has shifted to be more exurban,” Burns said. “Just how much is really hard to tell.”

Hutchinson sees pandemic flight as an insulator for developments in more rural areas.

“This post-covid work shift will be sticky,” he said. “It will bolster the outer-ring markets so they will be more resilient than in previous downturns."

Mynd Investment Management is your institutional partner for real estate investing in single-family rentals, including build-to-rent portfolios.