One longstanding guideline for property investors that has been the subject of countless articles is “the 1 percent rule in real estate.” It’s a quick and easy screening tool that can eliminate properties that may not offer good cash flow.

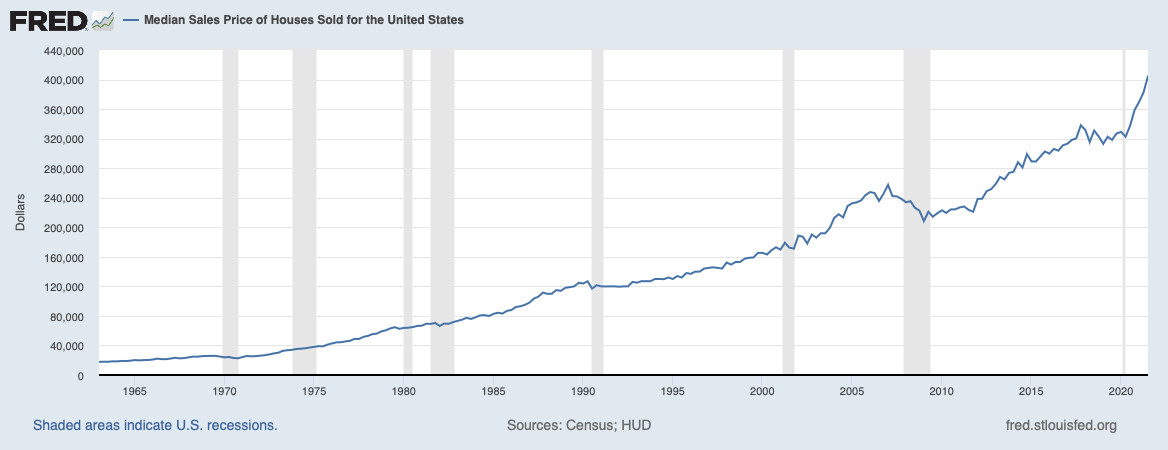

Sounds great, right? The problem is that in the current environment, with house prices climbing and interest rates at just about 4 percent on investment loans, the 1 percent rule would steer investors away from many properties in strong markets that are worth a close look.

Let’s look at the 1 percent rule in real estate and see how investors have typically used it.

What is the 1 percent rule in real estate?

The 1 percent rule is a formula that says the monthly rental should equal at least 1 percent of the total cost of an investment property to return a positive cash flow.

If an investor is looking at a home with a purchase price of $150,000, therefore, she should plan to charge at least $1,500 rent:

So if there are renters currently in the investment property who are currently paying $1,500 or more, the property passes the test. If it’s currently vacant, and the going rent for a similar property in this market is $1,500, it also passes.

If renters are currently paying just $1,250, obviously, it doesn’t pass the test, so the investor might choose to look elsewhere, or make an offer of $125,000 or less. If the renters are currently paying $2,000, it passes with flying colors.

It’s important to remember that the 1 percent rule in real estate is just a guideline. There are many factors that weigh into an investor’s decision about whether a property is a good investment. Among them are the quality of the neighborhood, the quality of the home, vacancy rates, and possible rent increases.

It’s also important to remember that many costs aren’t included in the calculation of the 1 percent rule. Expenses like maintenance, taxes, insurance and operating costs don’t enter into the equation. Some properties might meet the 1 percent rule but have huge deferred maintenance costs, making them a less-than-solid investment.

Why the 1 percent rule in real estate is lacking in a booming market

While the 1 percent rule may have served well as a screening tool in the past, it’s not helpful in the current moment, of home values soaring at unprecedented rates and interest rates still near the lowest in history.

“There are legacy screening metrics that worked very well 20 years ago,” says Thomas Stepp, Mynd Management’s director of investment services. “This rule helped the investor to know that rent on a property would cover expenses and let them put some money aside. In a higher interest rate environment, the 1 percent rule makes sense.

“But when interest rates are lower, and you see price and rent appreciation outpacing inflation, finding quality within that rule is highly unlikely.”

Properties that would cost an investor only $200,000 but would command $2,000 in rent “just don’t exist,” says Stepp. “The market isn’t trading that way anymore.”

As an example, the median home price for a single-family home in Austin in 2019 was $335,095. For that price, an investor would have to charge about $3,350 in rent to meet the 1 percent rule. But the median rent at that moment was about $1,550, so the investor following the 1 percent rule would have looked elsewhere.

When rents are low, but appreciation is high

But that would lead to regrets. The median home price in the Texas capital, as of September 2021, was a whopping $536,000, so that hypothetical investor would have missed out on a 60 percent appreciation.

Even factoring in two years in which the investor accepted the median $1,150 in rent rather than the $3,350 required to pass the test, that’s a loss of $52,800, against a home appreciation of $200,905.

“People are paying a premium for future value in markets like Charlotte or Atlanta,” says Stepp. “They know that the rents are going to rise faster. The balance between costs out and cash flow in may not be ideal at time of acquisition, but within five or 10 years, they know the numbers will be more like what they’re looking for.”

Conversely, a novice investor applying dated metrics would end up investing in risky investment properties in unfavorable markets.

Stepp compares real estate’s 1 percent rule on real estate investing with guidance on stocks from a bygone era.

Benjamin Graham, the economist who mentored Warren Buffett, is known as the father of value investing. His books Security Analysis (co-written with David Dodd in 1934) and The Intelligent Investor (1949) were profoundly influential. Buffett called the latter “the best book about investing ever written.”

“His book served as the Bible for investors for a long time,” says Stepp, “but if you tried to apply those principles today, you’d never buy anything, because the stock market today looks to the future.”

Similarly, smart real estate investors may now look at an area where rents are modest but where population and employment are forecast to grow, which will drive demand for housing, and see a promising investment.

Stepp acknowledges that in the future — perhaps an environment with higher interest rates — the 1 percent rule may be useful once more. So while it may be a good moment to put the 1 percent rule on the shelf, an investor might at some point want to take it down and dust it off.